China and the West in Africa: Case of Zambia's Mining and Financing

Zambia’s Bad Credit Bet for China, Good Mining Gamble for the West

Updated addenda: 9/4/24

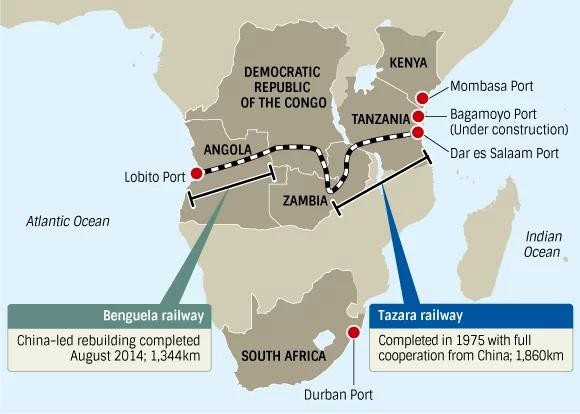

Lobito Railway Corridor and Angola Port

The Lobito Atlantic Railway has successfully exported the first shipment of copper from mines in the Democratic Republic of Congo to the United States of America.

Lobito Atlantic Railway began exporting copper from the DRC to the United States. Lobito, Angola, 22 August 2024 – The first shipment of copper destined for the United States left the Port of Lobito, Angola this week loaded onto the MSC SAMU container vessel.

The cargo of copper cathodes is headed to Baltimore after arriving by train at the port of Lobito in Angola on Aug. 19, part of a consortium with a concession for the line.

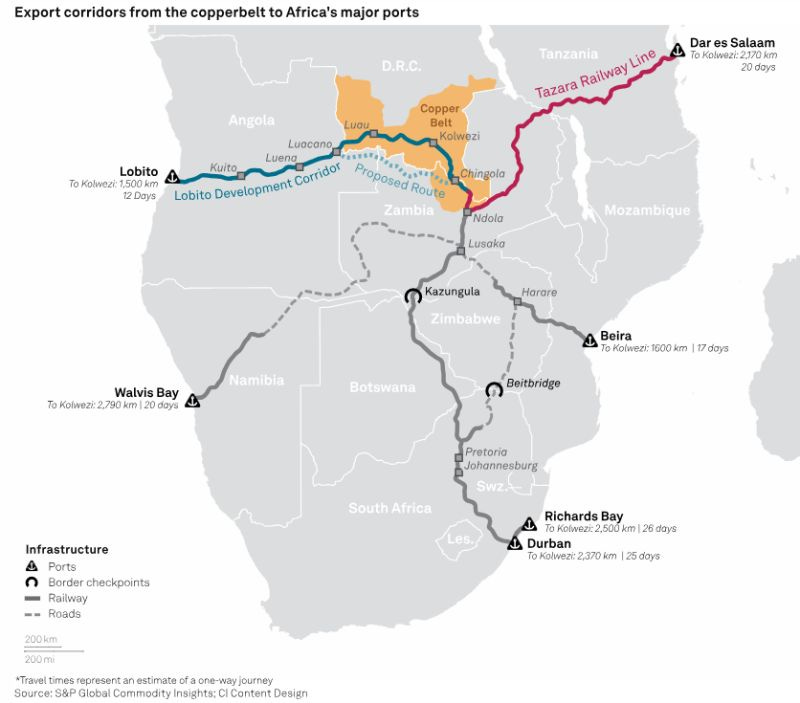

The six-day rail journey demonstrated “the time-efficient western route to market that is now available for mining products and metals produced in the Congolese Copperbelt,” the trader said.

The Lobito corridor is a key export pathway for mining such as copper and cobalt from the Democratic Republic of Congo and Zambia.

The US-bound cargo, loaded onto the MSC SAMU container vessel, marks a pivotal moment following the previous shipments to Europe and the Far East since the railway's concession takeover in January.

Angola, DR Congo and Zambia are AfCFTA member countries

In the case of Lobito investment, China holds the primary role, and in Central Africa and Sahel, Russia has the military power making Africa more tuned toward a nationalistic approach for its development and using colonialism and neo-colonialism as the reason for changing the rulers by new military militants instead the legation of the western countries.

The Lobito Corridor project may inadvertently benefit Chinese companies more than originally intended.

Lobito Investment

The Lobito Atlantic Railway project, covering Angola, the Democratic Republic of Congo (DRC), and Zambia, is a significant infrastructure initiative. Led by the United States, the project aims to enhance logistical infrastructure in southern Africa. However, Chinese state-owned enterprises and private companies already dominate critical mineral supply chains (such as copper and cobalt) for electric vehicle components.

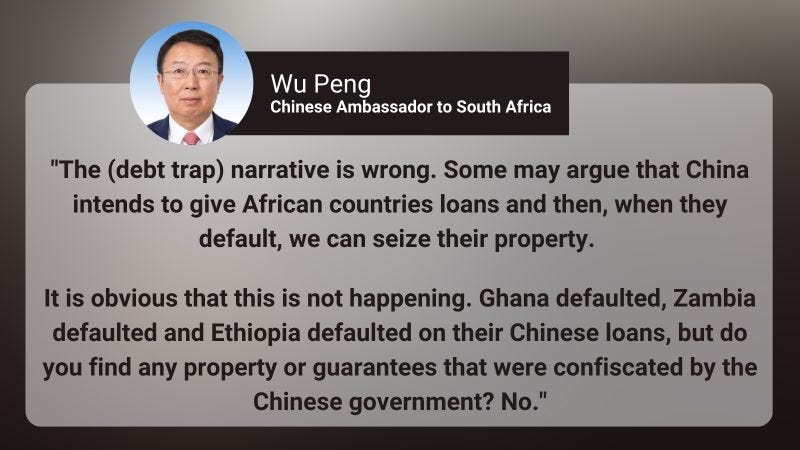

A spokesperson for China’s Ministry of Foreign Affairs (MOFA) told CNN via email that China has paid “high attention” to the African debt situation, and is dedicated to “sustainable development.”

Said El Mansour Cherkaoui Ph.D. - Said Cherkaoui Ph.D. 9/4/24

This publication has up to this 8/2/2024, 2,683 impressions and it keeps going up up up ... and on 8/13/2024 it is 2,714 impressions

In the present article, we will emphasize the reasons for the setback experienced by the restructuring and rescheduling of Zambia's External Debt and how even with the twist of events and alliances other projects such as the Liboto Corridor Project can become a double edge sword with 2 sharp sides and even to be transformed in the Sword of Damocles put on the top of the Zambia Head.

Zambia’s Bad Credit Bet for China, Good Mining Gamble for the West

Said El Mansour Cherkaoui Ph.D. on LinkedIn •

Contact author – saidcherkaoui@triconsultingkyoto.com

When the Missionaries arrived, the Africans had the Land and the Missionaries had the Bible. They taught us how to pray with our eyes closed. When we opened them, they had the land and we had the Bible. – Jomo Kenyatta

Reactions 2,714 impressions

#zambia #democraticrepublicofcongo #africa #africanews #china #europeancommission #usa #debtcrisis #debtfinancing #export #minerals #infrastructureinvestment

Posted on November 22, 2023, by Said El Mansour Cherkaoui Ph.D.

Introduction:

In this article, we will highlight the reasons for the setback suffered by Zambia’s external debt restructuring and rescheduling and how even with the turn of events and alliances, other projects such as the Liboto Corridor Project can become a double-edged sword with 2 sharp sides. and even turn into a sword of Damocles hanging over Zambia’s head.

The African School of Development and Finance should use the case of Zambia to teach our leaders and managers how to avoid being lured, attracted and ultimately punished by those who, from the beginning, have sought and wanted to control and make the Zambian economy obey their principles and concepts of neoliberal development imported from outside while they will eventually export to them and for their benefit all the internal mining assets and local values.

Zambia is a typical study and an open textbook on how to fall into the net of modernization and at the same time avoid falling into the trap of external debt, framed and camouflaged in a neoliberal strategy of infrastructure upgrading through the adoption of financing tools of and provided by the development policies controlled by the Western state and their army of corporate executives who have transformed Zambia into a bargaining chip in the international competition between the West and the East.

Zambia’s position in the international financial system and the international commodity market is typical of many African countries where external debt is a trap into which they fall without knowing where the bottom lies and what snowball effect could later make this debt yield no return or added value to the state coffers. Such lack of revenue and timely and cost-effective project delivery has made the financial position of many African countries vulnerable to all manner of manipulation and acceptance of additional control and conditionalities by international creditors and their linkages in other economic, commercial and corporate sectors.

This article highlights Zambia’s efforts to escape the debt trap that has become a “Typhoon”, slowly stifling any move by the country towards acquiring infrastructure that will help the economy emerge from its landlocked conditions of existence and the enclave characteristic of the economy. is still visible. Since the establishment of colonial rule, the Zambian economy has been largely centered on the extraction of minerals, particularly copper, cobalt, and associated by-products. International financial organizations such as the World Bank, IMF, International Finance Corporation, and the European Central Bank are promoting private sector development and attracting foreign direct investment, particularly by building adequate and modern logistics infrastructure that opens horizons across other countries to reach more distant spaces and meet distant demands for locally produced goods.

Unfortunately, this looks like an overly optimistic effervescent eruption and distribution of high figures as growth rates for African economies that have been orchestrated by the World Bank, IMF, IFC, and the European Central Bank and their subsidiaries and sycophants such as Think Tanks, Research Centers, investment firms and financiers who painted a very rosy picture of Africa in 2010.

Their misinterpretation of Africa’s idyllic development has directly contributed to the unequivocal difficulties and distortions in the health and economic conditions of African countries. These sophisticated intrigues have resulted in the high indebtedness of many African countries that are actually on the verge of default or receiving additional funds to remedy their descent into new financial problems, economic imbalances, and social unrest. Many coups in Africa result from such a combination of financial factors and economic dispossession stemming from an external impact.

Indeed, a World Bank study published in November 2010 suggests that half of the 5 percent growth that Africa enjoyed between 2003 and 2008 was due to improvements in infrastructure, mainly telecommunications. At the same time, the International Monetary Fund estimates that growth in sub-Saharan Africa will be one percentage point higher than the world average and ranks eight African countries among the 20 fastest-growing economies in 2010. The oil-rich Angola and the Republic of Congo are leading with growth rates of over 9 and 12 percent respectively, beating China, according to the most recent IMF projections [ Source: Davos Special Report: Africa Rising ].

These world-class financiers were throwing out overly optimistic figures left and right about the growth rate of these countries that had presented them as the new El Dorado of the flow and recycling of dollars in loans without even considering the existence of the payment of the service. Indebted African countries have become easy to penetrate by foreign interests and foreign assets. At the same time, African countries, instead of investing in their exports, have also been forced to diversify their outsourcing of capital, use part of it to pay debt service and finance their security and solvency.

Today, we are witnessing the same approach and discourse of launching forecasts without even looking at the historical patterns of changes or seasonal variations in growth rate, inflation rate, and currency conversion rate for African economies and this is just to refer to the most ambivalent factors and indicators.

Zambia’s Bad Credit Bet for China, Good Mining Gamble for the West - February 11, 2024

Said El Mansour Cherkaoui Ph.D.

★ Strategic Catalyst Driving U.S.A-Africa and Morocco Investment, Trade, and Business Development ★ Policy Adviser in International Affairs ★ Accomplished Public Speaker ★ Distinguished News Editor ★

Zambia’s Bad Credit Bet for China, Good Mining Gamble for the West

Said El Mansour Cherkaoui Ph.D.

★ Strategic Catalyst Driving U.S.A-Africa and Morocco Investment, Trade, and Business Development ★ Policy Adviser in International Affairs ★ Accomplished Public Speaker ★ Distinguished News Editor ★

February 11, 2024

Contact author – saidcherkaoui@triconsultingkyoto.com –

When the Missionaries arrived, the Africans had the Land and the Missionaries had the Bible. They taught us how to pray with our eyes closed. When we opened them, they had the land and we had the Bible. – Jomo Kenyatta

Presentation:

In this article, we will emphasize the reasons for the setback experienced by the restructuring and rescheduling of Zambia’s External Debt and how even with the twist of events and alliances other projects such as the Liboto Corridor Project can become a double edge sword with 2 sharp sides and even to be transformed in the Sword of Damocles put on the top of the Zambia Head.

Africa Destiny: Low Blow to China BRI at Lobito -

African School of Development and Financing should use the case of Zambia to teach our rulers and leaders how to avoid being attracted, lured, and finally punished by those from the start who sought and wanted to control and make the Zambian economy obey their principles and concepts of Neo-liberal development imported from outside while they will end by exporting to themselves and to their benefit all the internal mining goodies and local values.

Zambia is a Typical Study and an Open TextBook on how to fall into the modernization net and at the same time how to avoid falling into the External Debt Trap framed and camouflaged inside a Neo-liberal strategy of infrastructural upgrade through adopting the financing tools from and furnished by Westernized State-controlled development policies and their army of corporate officers leading up Zambia being transformed into a bargaining chip in the international competition between the West and the East.

Zambia’s standing in the International Financial System and the International Commodity Market is typical for many African Countries where External Debt is a trap that they fall into without knowing where the bottom is and what the snowball effect later could make this debt not produce any return or added value to the State coffers. Such lack of revenue and concretization of the projects on time and in good cost efficiency standing made the Financial situation of many African countries vulnerable to all kinds of manipulation and acceptance of further control and conditionality from international creditors and their connections in other economic and trade sectors and companies.

Zambia has made a debt deal with China and other creditors to restructure $6.3 billion in loans. The deal includes $4.1 billion owed to China. Zambia has also made a debt restructuring deal with bondholders. The deal would reduce the present value of the restructured external debt by about 40%. Monday February 12, 2024

This article sheds light on the efforts made by Zambia to escape the debt trap that became “Typhon” suffocating slowly any move of the country toward acquiring an infrastructure that will help the economy escape its enclaved conditions of existence and the enclave feature of the economy, is still conspicuous. Since the establishment of colonial rule, the Zambian economy has largely centered on the extraction of minerals, particularly copper, cobalt, and related by-products. International financial organizations such as the World Bank, the IMF, the International Finance Corporation the European Central Bank encouraged the development of the private sector and the attraction of foreign direct investment notably by building adequate and modern logistic infrastructure that opens horizons through other countries to reach farther spaces and respond to distant demands for the locally produced goods.

Unfortunately, it is similar to overly optimistic effervescent eruption and distribution of high numbers as rates of growth for African economies that were orchestrated by the World Bank, the IMF, the IFC, and the European Central Bank and their subsidiaries and courtesans such as Think Tank, Centers of Research, investment firms and Financiers that have elaborated in 2010 a very rosy picture of Africa.

Their fake elaboration of the idyllic development of Africa has contributed directly to univocal difficulties and distortions of the economic health and conditions of African countries. These sophisticated intrigues resulted in the high indebtedness of many African countries that are actually in the level and range of defaulting or receiving additional funds to correct their diving into further financial troubles, economic imbalances, and social unrest. Many coup d’etat in Africa have resulted from such a combination of financial factors and economic spoliation all coming from outside impact.

Effectively, a World Bank study released in November 2010 suggested half the 5 percent growth Africa enjoyed from 2003-08 was due to improvements in infrastructure, mainly telecommunications. At the same time, the International Monetary Fund believes growth in sub-Saharan Africa will be 1 percentage point above the global average, and puts eight African countries in its top 20 fastest-expanding economies in 2010. Oil-rich Angola and Congo Republic will lead the charge with growth rates of more than 9 and 12 percent respectively, both beating China, according to the IMF’s most recent projections [Source: Davos Special Report: Africa rising].

These world-level financiers were throwing left and right overly optimistic numbers on growth rate in these countries that had presented them as the New El Dorado making the flow and recycling of dollars in loans without even considering the existence of the payment of the servicing. The indebted African countries became easy to be penetrated by foreign interests and foreign goods. At the same time, African countries instead of investing in their exports, were also obliged to diversify their outsourcing of capital and use part of it to pay the debt servicing and the financing of their security and solvability.

Today, we are seeing the same approach and the same discourse of throwing predictions without even looking at the historical patterns of changes or the seasonal variations of the rate of growth, the inflation rate, and the rate of conversion of the currencies for African economies and this just to refer to the most ambivalent factors and indicators.

Plus Royalist que le Roi

Here the same bragging presenting and predicting the future of Africa to be brighter and higher than India while in 2010 it was projected to be higher than China, their inflation already talk and if these economists – Madame Soleil and Fortune Tellers continue in the same jumps, they will be soon running out of country for the speaking of African economies to the top of the World.

🚀 Sub-Saharan Africa: A Future Economic Powerhouse! 🌍 Source: Axel Peyriere • 2nd • CEO & Co-Founder @ AUTO24.africa | 50+ Startups Inve

📈 Sub-Saharan Africa’s GDP is set for a massive leap!

Said El Mansour Cherkaoui Reply and Comment: this is a really funny statement which I will continue with my comment that I will write as the following:

📈 Sub-Saharan Africa’s GDP is set for a massive leap! that it will precipitate African companies in the deep ravine!

🚀 From $2,000B today to a staggering $4,500B by 2040! Said El Mansour Cherkaoui Reply and Comment: John Maynard Keynes will respond to this one by saying in the long run we will be all gone.

💹 That’s more than double! 🌟 The spotlight is on East Africa, poised to be one of the world’s fastest-growing regions.

🎖️ Ethiopia , Kenya , Uganda , and Tanzania are leading the charge, driving unprecedented economic growth in the area.

Said El Mansour Cherkaoui Reply and Comment: These are considered the most indebted economies and largely dependent on the exports of commodities that are subject to wide variations given the fluctuations of the exchange rate of their currencies and the staggering inflation of the prices for imports.

🔍 Let’s put this into perspective:

🌍 In 2022, Sub-Saharan Africa made up 15% of the global population but contributed just 2% to the world’s GDP.

🌐 🌏 The upcoming growth trajectory is expected to outpace even that of India and Vietnam. 📊

Said El Mansour Cherkaoui Reply and Comment:

At the same time, the International Monetary Fund believes growth in sub-Saharan Africa will be 1 percentage point above the global average, and puts eight African countries in its top 20 fastest-expanding economies in 2010. Oil-rich Angola and Congo Republic will lead the charge with growth rates of more than 9 and 12 percent respectively, both beating China, according to the IMF’s most recent projections [Source: Davos Special Report: Africa rising].

The existence of imbalances between debt and exports has also added more hurdles to African countries to serve their external. The diminution of foreign currencies by the exports implies further financial difficulties for African countries given that 40% of their debts were denominated in foreign currencies, which makes African countries vulnerable to exchange rate fluctuations. Add to this are the sharp increases in international interest rates and the continual dependence on commodity exports that were susceptible to price volatility. Within such range, Ethiopia, Ghana, Malawi, and Zambia were economies that were critically or very critically indebted.

Zambia’s Attempt to Increase its Revenues from Mineral Exports

Within such an unstable environment, one of the major mining copper called the Liboto Corridor Project has been one of the targets of China as a hub for investment and supply of its needed copper. China and Zambia have been deepening their cooperation through the Belt and Road Initiative and the Forum on China-Africa Cooperation. More than 600 Chinese businesses have invested over $3 billion in Zambia, creating 50,000 jobs. In the first half of 2022, the bilateral trade volume between the two countries was $3.76 billion.

The Lobito Corridor is a trade passage that connects the Atlantic Ocean port of Lobito in Angola to Zambia, Angola, and the Democratic Republic of Congo. The corridor is a shorter route to the sea for key mining regions in these countries. It could also change how resources are shipped in the region. The corridor runs from the Port of Lobito on the Atlantic Ocean, through the provinces of Benguela, Huambo, Bie’, and Moxico. It then connects with the mineral-rich regions of Zambia and the Democratic Republic of Congo. The corridor connects 40% of Angola’s population.

The African Development Bank, Africa Finance Corporation, the United States, and the European Union are supporting the development of the Lobito Corridor. The three countries have also agreed to establish a new agency to oversee the corridors' development.

The Bright Side of the Moon Shining Zambia for the Investors: Lobito Corridor Project

Zambia found the Liboto Corridor Project with its promising copper production as the future collateral of its offers to be compliant with the demands of the foreign creditors. Copper is actually in demand and its exploitation by U.S. and European companies through the support of the U.S. Government and the European Commission. Such backup has helped Zambia to be a serious contender for infrastructural projects to be financed by the financiers and even feasibility studies will be financed by the authorities and those of the European Union giving a seal of approval and legitimacy to the Liboto Corridor Project.

The Dark Side of the Moon Shading Zambia for the Creditors: Setback Restructuring

However, a hidden agenda was planted under the table of the negotiation for the rescheduling and restructuring of Zambia’s external debt which is an unspoken directive by the Western-based decision-makers slid by the turn of events to their favor which means that the authorities of Lusaka and the Zambesi needed to drop the China option for the Liboto Corridor Project.

More analytical and presentation in the following lines of this article:

Breaking News on Restructuring Debtrapped Zambia

Zambia’s debt has been increasing. In 2022, the country’s national debt was around $23.23 billion. The government debt in Zambia was $13.9596 billion in 2022, which was an all-time high. Zambia’s external debt reached 8.7 billion USD in June 2023. The country owes $6.3 billion to official bilateral creditors, with the majority ($4.2 billion) due to China. Zambia also owes $3.5 billion to multilateral creditors, who are not part of the restructuring negotiations.

Below is a condensed timeline of key events :

2019-2020: Zambia faced challenges in repaying its debts, including its international market dollar-denominated government bonds known as “Eurobonds”.

2020: The country requests to have its debt payments frozen under the G20-led Debt Service Suspension Initiative (DSSI) due to COVID-19.

In May, Zambian President Edgar Lungu’s government hired French firm Lazard to advise on restructuring the cash-strapped southern African nation’s $11 billion worth of foreign debts.

In November, Lungu’s government missed a $42.5 million payment on one of its international bonds, making it Africa’s first pandemic-era sovereign to default.

2021: Opposition leader Hakainde Hichilema secures a landslide victory in August over Lungu in presidential elections.

June 2022 – Governments that have lent to Zambia over the years form an “official sector” creditor committee – or OCC for short – to formally start working on restructuring the loans they have provided to the country.

2022: Negotiations continue with bondholders for debt relief and restructuring deals.

Zambia monnaie, Kwacha is among the worst performing in the world year-to-date

The currency has declined over 20% versus the dollar in 2023

2023: In June, the government announced the “Paris Club” of creditor nations and its other big bilateral lender China have agreed to restructure their combined $6.3 billion worth of loans. Just over $4 billion of that money is owed to the Export-Import Bank of China, underlining the importance of Beijing’s support for the deal.

October - The government strike an “Agreement in principle” deal with investment and pension funds that hold $3 billion worth of its sovereign bonds that it had sold on the global capital markets.

The deal proposes consolidating that debt into two bonds with easier terms and longer payment deadlines, but also offering additional faster payments if the country’s economy does well.

November – The deal suffers a major blow after the government says that its bilateral “OCC” creditors have effectively vetoed its other deal with its bondholders assessing that it doesn’t provide enough debt relief.

Angry bondholders say the OCC is demanding debt relief from them that is materially higher than either Zambia’s government or the International Monetary Fund deem necessary.

Public debt as a share of GDP reached an average of 56% in sub-Saharan Africa in 2022, the highest level since the early 2000s, exacerbated in part by COVID-19 and Russia’s invasion of Ukraine. That may not look high by rich-world standards, but it is barely affordable in Africa, where interest rates are much higher. May 16, 2023

27-Jul-2023

African governments owe three times more debt to Western banks, asset managers, and oil traders than to China, and are charged double the interest, according to research released today by Debt Justice. Western leaders through the G7 have attributed the failure to make progress on debt restructuring to China, [1] but the data shows that this is mistaken. Just 12% of African governments’ external debt is owed to Chinese lenders compared to 35% owed to Western private lenders, according to the calculations based on World Bank data.

Considering Zambia’s external debt payments from 2022 to 2028, 45% are to Western private lenders and 37% to Chinese public and private lenders. We have been campaigning for BlackRock, Zambia’s largest bondholder, to agree to cancel at least two-thirds of the debt. If BlackRock is paid in full, they could make 110% profit out of Zambia’s debt crisis.

China is not letting go easily what is at stake for its national interest and its early benefit in the copper mining of Zambia. China had made sure that Zambia’s debt restructuring efforts needed to be retailored according to its importance in the same loans. On Monday, November 20, 2023, the authorities of Lusaka announced that a revised deal to rework $3 billion of Eurobonds could not be implemented at this time due to objections from official creditors, including China.

The Dark Side of the Moon Shading Zambia for the Creditors: Setback Restructuring

Zambia has made a debt deal with China and other creditors to restructure $6.3 billion in loans. The deal includes $4.1 billion owed to China. Zambia has also made a debt restructuring deal with bondholders. The deal would reduce the present value of the restructured external debt by about 40%. The deal involves issuing two new bonds to restructure claims on three existing bonds. The new bonds will mature in 2035 and 2053.

Zambia’s debt restructuring has been a complex, three-year process, Zambia’s debt restructuring efforts have been set back. which suffered a serious setback on Monday, November 20, 2023, when bilateral and official creditors, including China and France. The creditors have ordered Zambia to secure more debt relief from international funds that hold its sovereign bonds.

The creditors rejected a revised bondholder restructuring proposal, which would have reworked $3 billion of Eurobonds. The proposal would have issued two new bonds, with repayments going towards both interest and principal. The bonds would have matured in 2035 and 2053.

Negotiations on debt relief for Zambia finally set to begin

Zambia first applied for a debt restructuring through the G20s new Common Framework in February 2021. A debt restructuring means any change in the terms of the debt – which could be as small as reducing interest rates and the time over which a debt is to be paid – or as large as sizeable debt cancellation.

Under the Common Framework, the IMF and Zambia complete a Debt Sustainability Analysis, which calculates how much debt restructuring is needed to make the debt sustainable. This has been done but not made public. The Zambian Civil Society Debt Alliance and Debt Justice have calculated that government and private lenders need to cancel two-thirds of the debt to make the debt sustainable, using the IMF’s own methodology.

In agreeing to negotiate, the government lenders such as China and the UK, known as the Official Creditor Committee, said:

“The creditor committee stresses that the Zambian authorities are expected to seek from all private creditors and other official bilateral creditors debt treatments on terms at least as favorable as those being considered by the creditor committee”.

Where is Zambia at the moment along its path to debt sustainability?

The Zambian government received a major boost in its quest to restructure its debt by securing an Extended Credit Facility from the International Monetary Fund (IMF) to the tune of US$1.3 billion over three years. The Zambian authorities will use this bailout package as leverage to show that they have faith in their ability to achieve the necessary goal of economic recovery.

In an effort to avoid further debt distress, the government in the past few months announced the cancellation of US$2 billion worth of not-disbursed loans on a number of infrastructure projects.

Zambia cancels US$1.6 billion Chinese loans and halts infrastructure projects in a move to avoid a debt crisis. Zambia has canceled US$1.6 billion in agreed-upon but not-disbursed Chinese loans, mostly from China Exim Bank and the Industrial Commercial Bank of China, to help manage its debt woes. [Aug 1, 2022].

In 2020, Zambia became the first African country to default during the pandemic when it failed to make payments on US$17 billion of external debt, including US$3 billion dollar-denominated bonds. Lusaka owes Chinese lenders about US$6 billion, which went into building mega projects, including airports, highways, and power dams.

In addition to canceling contracts and stopping the disbursement of loans, Lusaka has received a reprieve after official creditors led by China and France agreed to provide debt relief.

The decision paves the way for the country to access a US$1.4 billion bailout from the International Monetary Fund. Still, Lusaka has to seek similar relief from private creditors over the US$3 billion it owes Eurobond holders.

It had sought debt relief from the Group of 20 wealthiest nations and its top private creditors under the G20’s new Common Framework to help more than 70 developing countries with post-COVID debt restructuring and relief. The process allows creditors to jointly renegotiate its foreign debt – even though China usually prefers bilateral negotiations.

The official creditor committee for Zambia – co-chaired by China and France with South Africa acting as a vice-chair and including IMF and World Bank staff – met on July 18 where they committed to offering Zambia debt relief.

The IMF Managing Director Singing Faster than the Music

IMF Managing Director Kristalina Georgieva welcomed the official creditors’ move to provide financial assurances, clearing the way for a fund program, saying it showed the “potential of the G20 Common Framework for debt treatment to deliver for countries committed to dealing with their debt problems”.

“The delivery of these financing assurances will enable the IMF executive board to consider approval of a fund-supported program for Zambia and unlock much-needed financing from Zambia’s development partners,” Georgieva said. “Amid elevated debt levels and tightening financial conditions, I look forward to the Common Framework working for other countries facing debt problems.”

According to the IMF, growth in Sub-Saharan Africa is expected to decline to 3.6% in 2023, down from 4% in 2022. The World Bank projects growth to slow to 2.5% in 2023, from 3.6% in 2022.

Regional Economic Outlook: Sub-Saharan Africa, Light on the Horizon? Download

Zambia’s Minister of Finance Situmbeko Musokotwane said the country would “continue to work with both official and private creditors to agree on the terms of the debt restructuring in line with the comparability of treatment principle”.

The Common Framework aims to help countries weather the COVID-19 storm with debt relief and restructuring, but besides Zambia, only Ethiopia and Chad have applied to join the plan, with most countries fearing that by seeking relief their credit rating will be downgraded by rating agencies. Source: South China Morning Post (SCMP)

Furthermore, as a result of debt service cost savings, strong economic outputs from exchange rate appreciation, and exceeding tax collection goals, the government also announced a budget surplus for its 2022 expenses.

Here are some related interesting articles and topics to read that are directly intricated in the debt crisis of Zambia. These articles provide also a perspective on the rivalry between Western nations and China in Africa and in Zambia and the surrounding countries that are the reasons for contentions in the negotiation of external debt and the financing of the infrastructure and the logistics for the exploitation and the exports of the local and regional natural and mining resources.

Dollar & Euro at Lobito: Low Blow to Beat China African Strategy

Said El Mansour Cherkaoui November 20, 2023

The national budget for Zambia’s fiscal year 2023 was presented in September by the government. Everyone will be paying close attention to the government’s funding priorities for the upcoming year. Aside from that, the first of three Eurobonds was set to mature in September 2022.

On July 17, 2022, following a budget plan presented by the Ministry of finance on Sunday, Zambia’s economy is projected to grow by just 2.7% in 2023, down from 4.7% in 2022, as contractions in the mining and energy sectors restrain growth. Domestic revenue as a share of the budget is supposed to increase from 57 percent in 2022 to 66.7 percent in 2023. However, domestic revenue as a percentage of GDP is expected to reduce from 21.1 percent in 2022 to 20.9 percent in the 2023 budget though (MTPB) projected it at 22%.

In order to provide a thorough economic recovery plan by the end of 2022, the Zambian authorities will therefore try to speed up negotiations in order to streamline the budget and take into account agreed-upon debt restructuring conditions and conditionalities tied to its IMF bailout package. As always positive declarations were fused from the IMF given that Zambia was the first country in Africa to default on its sovereign debt in 2020, and has finally since then completed a long-delayed debt restructuring plan with the International Monetary Fund (IMF).

As always, the IMF has a tendency to cheer all the countries that accept its lending conditionality and Zambia is no stranger to that. For this reason, the IMF as always right on the money, predicted that by 2026, the debt restructuring plan signed by Zambia with the International Monetary Fund will save the southern African nation $7.65 billion.

More ambitious targets were announced such as based on improvements in macroeconomic conditions and the enactment of reforms, the budget plan projects that Zambia’s GDP will grow by 4.8% in 2024, 4.3% in 2025, and 5.0% in 2026.

As Zambia works to restore fiscal sustainability, the country is experiencing a rise in confidence, according to Secretary to the Treasury Felix Nkulukusa.

“Zambia’s success in restructuring its $6.3 billion bilateral debt under the common G20 framework continues to garner support from regional and global institutions that are all part of the same international team playing in the Western Fields with the same rules for the game.”

Late Implication of the African Development Bank Group in Zambia Financial Troubles

The African Development Bank Group organized meetings in Lusaka, the country’s capital, bringing together representatives of the United Nations, the European Union, the International Monetary Fund, the World Bank, foreign governments, including the United States and the United Kingdom, as well as the private sector to support Zambia with financial and technical support.

The President of the African Development Bank, Dr. Akinwumi Adesina, led the bank’s delegation to the meetings about which he then said: “The starting point now is to make sure the debt treatment works and that Zambia doesn’t have a debt crisis again.”

Adesina outlined several measures which, when approved by the Bank’s Board of Directors, will provide a total of $318 million to Zambia from the bank. Part of the annual allocation will be taken from the African Development Fund to finance major infrastructure projects, including road and rail transport links with Mozambique, Angola, and the Democratic Republic of Congo.

The African Development Bank Group convened meetings in Lusaka on July 4, 2023, bringing together representatives from the United Nations, the European Union, the International Monetary Fund, the World Bank, foreign governments—including the United States and the United Kingdom—as well as the private sector to rally behind Zambia with financial and technical support. African Development Bank President Dr Akinwumi Adesina led a delegation to the meetings. “The starting point is to now make sure the debt treatment works, and that Zambia does not again return to a debt crisis,” he said.

Adesina outlined several measures that, once approved by the Bank’s Board of Directors, will deliver a total of $318 million comprising $150 million for budget support to Zambia from the Bank. The remaining annual allocation of $168 million will be drawn from its concessional window, the African Development Fund, to finance large transformative infrastructure, including energy, road, and rail transport connections with Mozambique, Angola, and the Democratic Republic of Congo.

The Head of the European Union delegation in Zambia and the Common Market for Eastern and Southern Africa (COMESA), Jacek Jankowski said the EU had resumed budget support to Zambia starting with €299 million. “In addition, the European Union will provide €60 million for health and education, €30 million for the rehabilitation of the Kariba Dam (which provides a third of Zambia’s power generation) and the remaining €20 million will support smallholder farmers,” Jankowski said.

The World Bank has already approved a $275 million development policy operation for Zambia in support of the country’s reforms to restore fiscal and debt sustainability and promote private sector-led growth. The IMF last August approved a $1.3 billion program over three years to support the government’s reforms to help bring public debt back under control.

IMF Resident Representative in Lusaka, Preya Sharma, said Zambia was “doing a lot on reforms”. “It is undertaking large and important reforms including the removal of fuel subsidies, improvements in public debt management and governance,” she said.

Most of Zambia’s external debt is held by bilateral creditors, but there was a rapid growth in private debt that almost tripled within six years to $18.8 billion in 2020.

The African Development Bank is offering Zambia the full services of the African Legal Support Facility(link is external) (ALSF) to renegotiate the terms and conditions of debt with private external creditors. The ALSF, established in 2008, has assisted several countries in creditor engagement and negotiations related to debt restructuring and relief. In 2021, the ALSF government savings in underlying transactions worth $14.8 billion.

President Hakainde Hichilema of Zambia has spent his first two years in office fighting to free his country from the grip of what he described as a “python of debt”. “It was impossible to do anything. We have lost a lot of time under the python of debt. We want the economy to function to help the government deliver for the people of Zambia,” he said.

Zambia needs technical and advisory support to deliver reforms in public financial management, public debt management, public investment management, streamlining procurement rules and systems, strengthening of public-private partnerships, domestic resource mobilization, increasing transparency, and fighting corruption.

At a separate meeting, Dr Adesina told private sector CEOs to take advantage of emerging opportunities and invest more in the country. The bank chief gave the example of the agriculture sector where “the Bank will provide support to help Zambia’s reform its farm input support program to be more efficient, transparent and delivered by the private sector, using biometric registration of farmers and use of electronic vouchers to deliver support directly to farmers.” The president of Zambia’s Chamber of Commerce and Industry, Chabuka Kawesha, pointed to the weaknesses of the energy sector. “Power delivery is quite poor, especially in terms of transmission which is needed to spur power generation,” Kawesha said.

Development partners are convinced that the government under President Hichilema, a businessman and farmer, will create the much-needed enabling environment for the private sector to play a leading role in investing across other key sectors such as the financial, transport, energy, and mining.

READ MORE ON: Zambia – African Development Bank

Africa Destiny: Mining and Minerals

Africa Destiny: Congo Mining Development

The Bright Side of the Moon Shining Zambia for the Investors: Lobito Corridor Project

The Democratic Republic of Congo, Angola, and Zambia, member countries of the Southern African Development Community (SADC), have signed the Lobito C

The Democratic Republic of Congo (DRC), Angola, and Zambia, member countries of the Southern African Development Community (SADC), have signed the Lobito Corridor Transit Transport Facilitation Agency (LCTTFA).

The Lobito Corridor represents an alternative strategic outlet to export markets for Zambia and DRC and offers the shortest route linking key mining regions in these two countries to the sea. In Angola, the Corridor connects 40% of the country’s population and several large-scale investments are taking place in agriculture and retail in the provinces of Benguela, Huambo, Bie, and Moxico traversed by the Corridor.

Lobito Corridor Transit Transport Facilitation Agency

In DRC, the Corridor connects the mining provinces of Tanganyika, Haut-Lomami, Lualaba and Haut-Katanga. Copper concentrates are currently transported from these DRC Provinces to Zambia for smelting for further export and the Corridor offers a potential conduit to overseas markets. The Project has three main components, namely:

Capacity Building for Trade Facilitation and Corridor Coordination,

Technical Assistance for Value Chains and Economic Clusters Development and

Project Management.

The LCTTFA Agreement aims to provide an effective and efficient route that facilitates the transportation of goods within territories between the three Corridor Member States, through harmonization of policies, laws, and regulations; coordinated joint corridor infrastructure development strategies and activities; dissemination of traffic data and business information; and implementation of trade facilitation instruments to support greater participation of small and medium enterprises (SMEs) in business value chains mainly in agriculture and mining with the view of increasing trade and economic growth along the Lobito Corridor and across the SADC Region.

The Agency will promote the sustained maintenance of the infrastructure and stimulate the development of the Lobito Corridor, ensuring that such development, infrastructure and other support services meet the present and future user requirements and encourage the reduction of costs associated with the movement of cargo and passengers along the Corridor.

The Lobito Corridor is a multimodal transport facility in Africa. The corridor is also a Flagship – Flagtrain of the Biden administration’s efforts to compete with China. The Lobito Corridor is a US-backed project that involves building a railway and feeder roads in Zambia. The project aims to provide an alternative route to export markets for Zambia and the Democratic Republic of the Congo. The corridor will connect the two countries to the port of Lobito in Angola, which will provide access to regional and global trade markets.

In November 2022, the Angolan government signed a 30-year concession with a consortium of Trafigura, Mota-Engil Engineering and Construction Africa, and Vecturis, Belgium, to operate rail services and offer logistical support for the Lobito corridor, which runs for approximately 1290 km from Luau on the eastern border with the Democratic Republic of Congo to Lobito Port on the Atlantic Coast.

The project includes:

Railway: 550 km of rail line from the Jimbe border to Chingola in Zambia’s copper region

Feeder roads: 260 km of primary feeder roads

Partnership: A partnership of the United States with the European Union to expand the rail line

It consists of a network of roads, railway lines, airports, and the Port of Lobito. The project involves laying hundreds of miles of track from Zambia’s Copperbelt province to an existing line in Angola.

The Lobito Corridor is expected to:

Facilitate regional integration

Grow trade across Angola, Zambia, and the DRC

Increase regional competitiveness

Generate significant economic benefits for Zambians

The Lobito Corridor Project has three main components:

Capacity building for trade facilitation and corridor coordination

Technical assistance for value chains and economic cluster development

Project management

The Lobito Corridor has the potential to generate significant economic benefits for Zambians by upgrading critical infrastructure, expanding export possibilities, boosting the regional circulation of goods, and promoting job creation and regional travel.

As an immediate next step, the United States and the European Union will support the Governments in launching pre-feasibility studies for the construction of the new Zambia-Lobito railway line from eastern Angola through northern Zambia. This builds on the initial U.S.-led support to refurbish the railway section from the Lobito port in Angola to the Democratic Republic of the Congo.

Another Straw that Broke the Back of the Chinese Camel Supporting Zambia Debt

China and France Have Destroyed All That was Hailed as a Success Story by the African Development Bank, the European Union, and the IMF

Zambia’s success in restructuring its $6.3 billion bilateral debt under the G20 Common Framework continues to draw support from regional and global institutions.

These institutions seek to ensure that the country sticks to the agreed debt arrangement, tackles debt owed to private commercial creditors—including Eurobond holders—and implements reforms critical to its economic recovery and growth.

The African Development Bank Group convened meetings in Lusaka last week, bringing together representatives from the United Nations, the European Union, the International Monetary Fund, the World Bank, foreign governments—including the United States and the United Kingdom—as well as the private sector to rally behind Zambia with financial and technical support.

African Development Bank President Dr Akinwumi Adesina led a delegation to the meetings. “The starting point is to now make sure the debt treatment works, and that Zambia does not return to a debt crisis,” he said.

Adesina outlined several measures that, once approved by the Bank’s Board of Directors, will deliver a total of $318 million comprising $150 million for budget support to Zambia from the Bank.

The remaining annual allocation of $168 million will be drawn from its concessional window, the African Development Fund, to finance large transformative infrastructure, including energy, road and rail transport connections with Mozambique, Angola and the Democratic Republic of Congo.

The Head of the European Union delegation in Zambia and the Common Market for Eastern and Southern Africa (COMESA), Jacek Jankowski said the EU had resumed budget support to Zambia starting with €299 million.

“In addition, the European Union will provide €60 million for health and education, €30 million for the rehabilitation of the Kariba Dam (which provides a third of Zambia’s power generation) and the remaining €20 million will support smallholder farmers,” Jankowski said.

The World Bank has already approved a $275 million development policy operation for Zambia in support of the country’s reforms to restore fiscal and debt sustainability and promote private sector-led growth. The IMF last August approved a $1.3 billion program over three years to support the government’s reforms to help bring public debt back under control.

IMF Resident Representative in Lusaka, Preya Sharma, said Zambia was “doing a lot on reforms”. “It is undertaking large and important reforms including the removal of fuel subsidies, improvements in public debt management and governance,” she said.

Most of Zambia’s external debt is held by bilateral creditors, but there was a rapid growth in private debt that almost tripled within six years to $18.8 billion in 2020.

The African Development Bank is offering Zambia the full services of the African Legal Support Facility(link is external) (ALSF) to renegotiate the terms and conditions of debt with private external creditors. The ALSF, established in 2008, has assisted several countries in creditor engagement and negotiations related to debt restructuring and relief. In 2021, the ALSF government savings in underlying transactions worth $14.8 billion.

President Hakainde Hichilema of Zambia has spent his first two years in office fighting to free his country from the grip of what he described as a “python of debt”. “It was impossible to do anything. We have lost a lot of time under the python of debt. We want the economy to function to help the government deliver for the people of Zambia,” he said.

Zambia needs technical and advisory support to deliver reforms in public financial management, public debt management, public investment management, streamlining procurement rules and systems, strengthening of public-private partnerships, domestic resource mobilisation, increasing transparency and fighting corruption.

Dr Adesina told private sector CEOs to take advantage of emerging opportunities and invest more in the country.

At a separate meeting, Dr Adesina told private sector CEOs to take advantage of emerging opportunities and invest more in the country. The bank chief gave the example of the agriculture sector where “the Bank will provide support to help Zambia’s reform its farm input support programme to be more efficient, transparent and delivered by the private sector, using biometric registration of farmers and use of electronic vouchers to deliver support directly to farmers.”

The president of Zambia’s Chamber of Commerce and Industry, Chabuka Kawesha, pointed to the weaknesses of the energy sector. “Power delivery is quite poor, especially in terms of transmission which is needed to spur power generation,” Kawesha said.

Development partners are convinced that the government under President Hichilema, a businessman and farmer, will create the much-needed enabling environment for the private sector to play a leading role in investing across other key sectors such as the financial, transport, energy, and mining.

The Other Bright Side of Eastern Moon: Tazara Link to the Indian Ocean

Tanzania - Zambia Railroad Authority: Tazara and China: 1970 2024

In the 1960s, Zambia needed a rail link to the Tanzanian coast to transport copper, its main export. White-controlled Rhodesia, now Zimbabwe, had cut off Zambia's only route to the sea in response to the postcolonial transfer of power to Zambia's black majority.

President Nyerere echoed a sense of frustration after Western nations opposed the Chinese plans for the railway line, but did not offer any alternative. Nyerere later complained that Western nations opposed the Chinese plans for the railway, but did not offer him any alternative.

“… all the money in this world is either Red or Blue. I do not have my own Green money, so where can I get some from? I am not taking a cold war position. All I want is money to build it.” Julius Nyerere is quoted.

On September 6, 1967, an agreement was signed in Beijing by the three nations. China committed itself to building a railway line between Tanzania and Zambia, supplying an interest-free loan to be repaid over 30 years.

Under Mao Zedong and as part of a foreign aid project, China invested 1 billion yuan ($140.5 million). From 1970 to 1975, about 50,000 Chinese workers built the Tazara Railway, also called the Uhuru railway, 1,860 km (1,155 miles) connecting Zambia's copperbelt to Dar es Salaam on the Indian Ocean. It is China's largest overseas project to date enabling Zambia and Tanzania to have extensive trade with China.

During the visit to China in 2022 and 2023 respectively of presidents of Tanzania and Zambia, Chinese President Xi Jinping promised to support the modernization of the railway. Xi said the Tanzania-Zambia railway had become "a symbol of China-Africa friendship."

As rivalry grows for international control of critical mineral trade routes, China plans to spend $1 billion to refurbish a key rail line linking Zambia's copper mining operation to Tanzania's port of Dar es Salaam as part of its Belt and Road Initiative.

Du Xiaohui, the Chinese Ambassador to Zambia, presented to Zambian Transport Minister Frank Tayali a proposal to rehabilitate the Tazara Railway with an investment of US$1 billion, which would be carried out under the of a public-private partnership (PPP) over the coming years.

China appointed the China Civil Engineering Construction Corporation (CCECC), a subsidiary of the China Railway Construction Corporation, in 2023 to negotiate a concession for the operation of the Tanzania-Zambia railway line.

In December 2023, the CCECC appointed an 11-member team led by Peng Danyang, general manager of the Ethiopia-Djibouti Railway, to carry out an inspection from Dar es Salaam to Kapiri Mposhi in Zambia to assess the operational model and commercial of Tazara.

China aims to use the Tazara railway line to transport mining exports from Zambia and the Democratic Republic of Congo (DRC).

The renewed version of the Tazara railway will compete directly with a US- and EU-backed railway to connect Zambia's copper belt and mineral-rich DRC to the port of Lobito on the Atlantic coast of the 'Angola.

Brussels and Washington announced in late October that they would finance the rail project aimed at linking Zambia's resource-rich region to an existing line to the port of Lobito.

The United States and the EU are eager to acquire minerals essential to the manufacture of batteries and advanced electronic devices, including cobalt, which comes from the DRC and Zambia. Most of these minerals are now exported to China for processing.

Addenda:

Relevant Idioms and Wise Proverbs that are Instructive about Zambia’s Actual Trouble in the International Financial Market:

The idiom “between a rock and a hard place” describes a situation where someone must make a difficult decision between two equally undesirable options.

Zambia is between the U.S. and Europe built Black Rock and the Chinese Hard Great Wall

In French given that France also rejected the restructuring:

Zambia is entre l’enclume et le marteau – between the hammer and the anvil

Zambia is between the devil and the deep blue sea

In 1973, the mines of copper and their importance for the development plan implemented by the newly elected government of Chili led by Salvador Allende was the reason for his overthrow and assassination by the Chilean renegades of Pinochet. In Zambia, the decision-makers and the governing elites compare the external debt to a Python and this can be symbolically to what happened in Chili.

Behind the scenes of this coup d’etat, as a central organizer was the major copper multinational producer who owned the totality of the Chilian copper mines with an output and activities representing more than 25% of the national budget and by the coincidence of the destiny, its name was Anaconda. The Anaconda Copper Mine was an open-pit mine operated by Anaconda Copper Company from 1952 to 1978. The mine produced about 165 million tons during that time.

Our Business and our Services to You:

To contact the Author for public speaking, advising, or consulting engagement, please send an email to: saidcherkaoui@triconsultingkyoto.com

TRI CONSULTING KYOTO – TRI CK USA – info@triconsultingkyoto.com

– TRI CK USA can help you to expand U.S. investment and business in Morocco and we can also help Moroccans to export to California and Californians to export to Morocco and Africa.

– TRI CK USA has known California for 35 years of residency, work, research, business operations, academic work, and building and expanding business from overseas, up to China.

– TRI CK USA facilitated the first import of Moroccan Products, Egyptian Products, Tunisian Products, and Cameroonian Products to California while opening up foreign markets for California.

Hommage a Mr. Andre Uzan

Just a day ago, I discovered the presence of Mr. Andre Uzan on the social media LinkedIn and this article is dedicated to him to Honor and to Celebrate his importance in my learning process and in the building of my foundations of academic knowledge.

I consider Mr. Uzan as one of the cornerstones on which I built my academic learning, my acquisition of practical business knowledge, and my choices in my studies during the time when I was in the undergraduate and graduate SciencesPo Grenoble, Institut d’Etudes Politiques, Section Eco-Fi.

Without Mr. Andre Uzan, I believe that I would not be in this position writing these analyses and articles. I would be like many of my acquaintances during that time who have not been guided and supported as I had the privilege to receive from Mr. Andre Uzan: I would not be writing these notes but I would be as Otis still singing the blues on the border of coasts and river banks with a bottle on my side as a companion of destiny:

Sittin’ in the mornin’ sun I’ll be sittin’ when the evenin’ comes Watching the ships roll in Then I watch ’em roll away again, yeah

I’m sittin’ on the dock of the bay Watchin’ the tide roll away, ooh I’m just sittin’ on the dock of the bay Wastin’ time

I left my home in Mazagan – El Jadida Headed for Oakland next to Frisco Bay ‘Cause I’ve had nothin’ to live for It look like nothin’s gonna come my way

Songwriters: Otis Redding / Steve Cropper, arranged by Said El Mansour Cherkaoui

Join us also at LinkedIn

and/or to expand your network with Diaspora of African Executives, please join our Group here on LinkedIn: https://www.linkedin.com/groups/14248881/

Best wishes for success