With their unparalleled expertise and world-class technology, US companies are well-positioned to benefit from Africa’s tech market growth. However, to maximize this opportunity, they must address the needs of African users. Moreover, establishing stronger partnerships with the burgeoning African tech industry could greatly benefit these companies, enabling them to tailor their technologies to the preferences of underserved users and mitigate the impact of disinformation. By fostering relationships with Africa-based researchers and civil society groups, US tech companies could support the creation of a healthy digital ecosystem that promotes prosperity, security, and accountability for all users.

Over the past few years, Big Tech firms’ failure to address privacy concerns and combat disinformation has prompted a growing debate about the apparent conflict between their professed values and bottom lines. To succeed in Africa, US-based tech companies must recognize the falseness of this dichotomy. While investing in African businesses may yield financial rewards, investing in African citizens is the key to unlocking the continent’s vast economic potential.

Egypt - Fintech startup Dopay raises $13.5M Series A extension round to accelerate expansion in Egypt and launch a range of new financial services

Kenya - Affordable solar provider d.light raises $176M securitization facility from African Frontier Capital to scale its PayGo financing offering

South Africa - Travel fintech startup TurnStay raises $300K to expand operations into new countries

UK - Global fintech TerraPay secures $95M debt finance facility from IFC and BII to expand operations through partnerships with global money transfer operators

Investor Activity

LoftyInc's new Alpha Fund receives $7M rom European LP FMO, the Dutch development finance institution

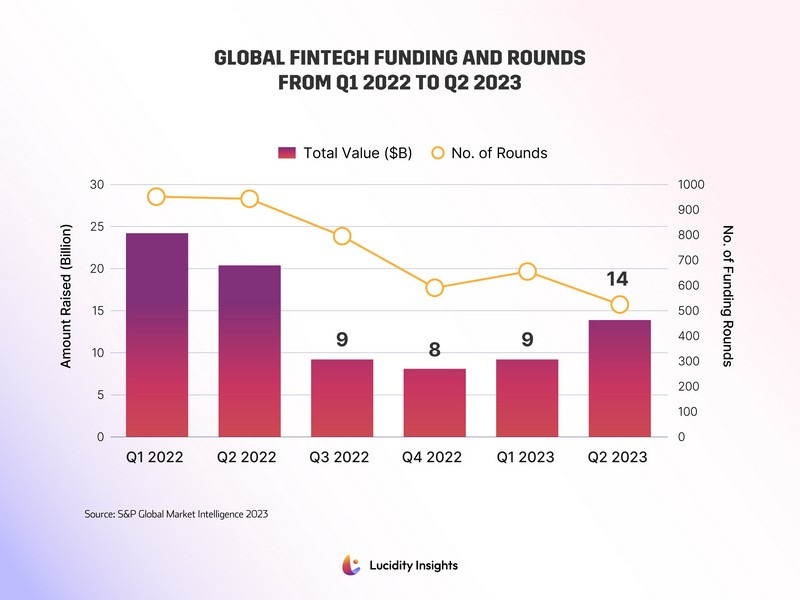

Global Fintech Funding and Rounds from Q1 2022 to Q2 2023

EMEA Fintech Funding takes the largest dive YoY in H1 2023, compared to other regions

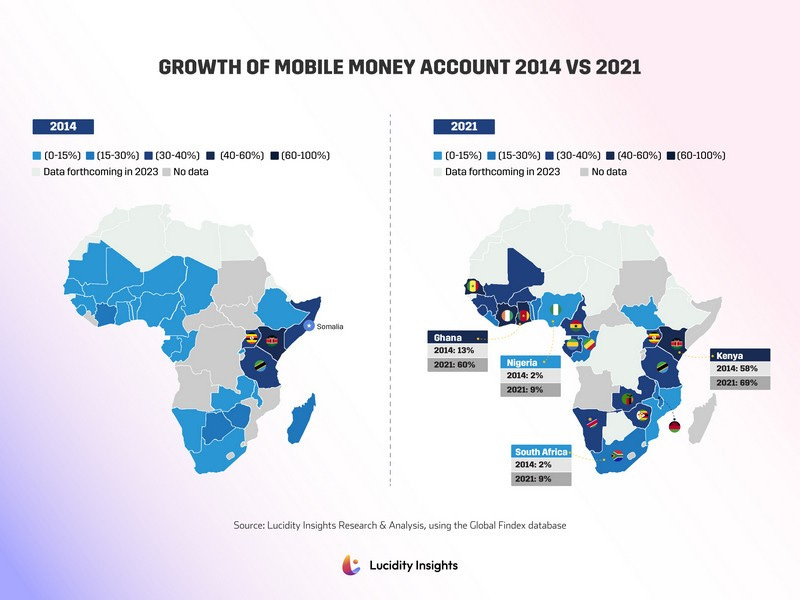

Africa has over half a billion mobile money accounts and it is the largest and fastest-growing fintech segment on the continent

Egypt, Iran, and Saudi Arabia technically have the largest addressable market sizes for fintech across the MENA region

The companies are well positioned to benefit from the growth of Africa’s tech but they must address the needs of African users

Day 1 at #GITEXAFRICA 2024 was a blast! 🙌🏻 From mind-blowing tech demos to inspiring keynotes, here are the top moments that made today unforgettable. We’re just getting started, so gear up for more innovation and excitement tomorrow. Thanks for joining us on this journey to shape Africa’s digital future!

At GITEX AFRICA, a Memorandum of Understanding was signed between the MICEPP – Ministry of Investment, Convergence, and Evaluation of Public Policies, the Ministère de la Transition Numérique et de la Réforme de l’Administration, the Moroccan Investment and Export Development Agency – AMDIE, and Oracle Systems Limited.

Oracle Systems Limited intends to increase its local Research & Development workforce to 1,000 information technology specialists; a move that follows the inauguration of its Moroccan Development Center at Casanearshore Park in Casablanca.

It is estimated that 40% of these new positions will be located outside the Greater Casablanca and Rabat-Salé-Kenitra regions, notably through the opening of new offices in Agadir this year, and in northern Morocco within the next two years. The objective set by Oracle is to enable researchers to leverage cloud, AI, and machine learning technologies to address the most pressing challenges in business, science, and the public sector.

“Oracle’s R&D center in Casablanca has already played a critical role in driving technical advances, improving cybersecurity, and developing new AI capabilities, [”…“] By strengthening our R&D presence in Morocco, we will be able to further leverage its vast talent pool to accelerate the development of solutions that will help our clients around the world grow their businesses and achieve success in their sectors,» said Safra C.

In this center of excellence, young Moroccans will be at the forefront of the design and development of innovative solutions using the latest technologies such as artificial intelligence, big data, cloud, and cybersecurity.

These solutions will be deployed on a global scale, thus strengthening Morocco’s positioning as a digital hub for the entire region.

In the same horizon, sky, and cloud line, Amazon Web Services (AWS) is getting into the fold of the Moroccan and North Sahara Africa to offer cloud computing in Morocco and Senegal using its AWS Wavelength platform in partnership with Orange, which was announced on Wednesday 29, May 2024.

One of the first of its kind the services will be provided without having physical AWS infrastructure such as data centers. Natural collaboration obliges, Orange will use and branch its physical data centers to shelter the AWS services. This AWS-Orange partnership, beyond language differences and origins, is responding to the rise of demand and needs for speeder and secured computing operations from banks, telecom firms, and healthcare firms.

There is a sense of a Gold Rush in Africa attracting cloud operators to service the rising cloud market that is expected to grow by 15% yearly to reach $18 billion in 2028, according to Statista.

Oracle Advent Stimulates Interest and Strategic

Amazon Web Services (AWS), an Amazon subsidiary that provides “cloud computing on demand” platforms and applications to individuals, businesses, and governments, plans to offer “cloud computing” to Morocco and Senegal using its AWS Wavelength platform in collaboration with the company French Orange. This is what we read in a joint statement from the two companies, according to which this will be the first time that the services will be available in a country without physical AWS infrastructure such as data centers.

Raising Capital Funding for Start-up in Africa 2017 (in Millions of dollars)

Google launched a network of free Wi-Fi hotspots in Nigeria on Thursday, August 9, 2018, as part of its effort to increase its presence in Africa’s most populous nation.

The U.S. technology firm owned by Alphabet Inc. has partnered with Nigerian fiber cable network provider 21st Century to provide its public Wi-Fi service, Google Station, in six places in the commercial capital Lagos, including the city’s airport.

Internet penetration is relatively low in Nigeria. Some 25.7 percent of the population made use of the internet in 2016, according to World Bank Data.

We are rolling out the service in Lagos today but the plan is to quickly expand to other locations.

The poor internet infrastructure is a major challenge for businesses operating in the country, which is Africa’s largest oil producer. Broadband services are either unreliable or unaffordable to many of Nigeria’s 190 million inhabitants.

“We are rolling out the service in Lagos today but the plan is to quickly expand to other locations,” Anjali Joshi, Google’s vice president for product management, told Reuters in Lagos.

The company said it aimed to collaborate with internet service providers to reach millions of Nigerians in 200 public spaces, across five cities by the end of 2019.

It said it would generate cash from the service in Nigeria by placing Google adverts in the login portal. Google did not disclose the amount invested in the new Nigeria service.

The technology firm said it planned to share revenues with its partners to help them maintain and deploy the Wi-Fi service but did not disclose the expected advertising revenue split.

Africa’s rapid population growth, falling data costs, and heavy adoption of mobile phones have made it an attractive investment prospect for technology companies.

Nigeria is the fifth country to launch Google Station. Similar services have been launched in India, Indonesia, Mexico and Thailand.

The service is aimed at countries with rapidly expanding populations. The United Nations estimates Nigeria will be the world’s third most populous nation, after China and India, by 2050.

“A lot of people who found data to be too expensive for them to use, are using it,” said Joshi. “In India, we have tens of millions of users, and close to a million in Mexico.”

However, many do not disclose how profitable the continent’s markets are, or if they make the companies money at all.

Last year, Google announced plans to train 10 million Africans in online skills within five years. It also said it aimed to provide $3 million in equity-free support to African start-ups.

Nigerian Vice President Yemi Osinbajo visited Google’s Silicon Valley headquarters this month to meet the company’s chief executive, Sundar Pichai.

The average size of the deals struck in Africa by startups also increased year-on-year at every stage of investment, with Series A funding, for example, increasing to around $3.7m. Series A refers to a company’s first significant round of venture capital financing. At the same time, the number of tech hubs in Africa has risen to 310, with 173 accelerators and incubators recorded in 2016, according to the World Bank. There were 117 in the previous year.

NORTH AFRICA

Trella - Egyptian trucking marketplace Trella is our first rising star of 2019, having raised more than US$600,000 in a pre-seed funding round; selected for Silicon Valley-based accelerator Y Combinator; and concluding the year by acquiring local competitor Trukt.

Founded last year, Trella operates a B2B trucking marketplace, connecting shippers with carriers in real-time, to make the entire supply chain faster and more reliable while reducing slack and exceptions.

This year’s impressive list of successes comes from a team that told Disrupt Africa they are taking growth “step-by-step”, and not making any hasty moves – so we’re eagerly anticipating the next set of well-planned moves the startup makes.

Eksab - from Egypt, we’re betting fantasy sports platform Eksab will keep up its winning streak in 2020.

Eksab is looking to tap into the MENA region’s love for football by providing users with exciting and engaging mobile games, to become the leading fantasy sports site in the region.

In its first year, the startup processed more than five million predictions, and in June secured a six-figure seed investment from 500 Startups to help it scale its product across the region.

With such a solid start to the startup’s growth plans, we’ll be keeping a keen eye on Eksab over the coming months.

Kaoun Tunisian fintech Kaoun is tackling the epic question of financial inclusion. The company’s first product, Flouci, is a mobile and web app that allows users to create free bank accounts remotely; facilitating the process through an innovative Know Your Customer (KYC) system via smartphone.

A critical component to any startup’s success, the team behind Kaoun is top-notch: co-founders Nebras Jemel, Anis Kallel, and Rostom Bouazizi put their studies in the United States – at Harvard University, University of Rochester, and Columbia University respectively – on hold to come back to Tunisia and build a fintech startup.

Launched in 2018, Kaoun has already raised funding from two angel investors and secured key partnerships with two Tunisian banks and the country’s National Digital Certification Agency. This startup is worth watching.

SOUTHERN AFRICA

FlexClub Here at Disrupt Africa, we’re interested to see how FlexClub fares in 2020, after a solid start since launching last year.

The South African startup allows users to purchase vehicles which are then matched with Uber drivers who pay a weekly rental charge to the investor.

With a solid founding team – including two former Uber employees; the startup raised US$1.2 million in a seed round led by CRE Venture Capital and also featuring Montegray Capital and Savannah Fund in March, amidst plans to grow its team and expand into new geographies.

Intergreatme Regtech startup Intergreatme can be credited as one of the first crowdfunding successes of Southern Africa; securing a whirlwind ZAR32.436 million (US$2.19 million) from 406 investors via the Uprise. Africa platform in May. Within six days it had already raised ZAR28.5 million (US$1.98m), with the startup limiting the raise to ZAR32 million which it managed in 2 weeks. The raise was marred slightly by the fact the startup later decided to reject a bulk of it after some investors failed compliance processes.

The fact still stands the startup is an attractive proposition, however, and we get what all the hype is about. Intergreatme has developed a web and app platform that digitises verified personal information for over 25 million credit-active South Africans; for streamlined use across businesses and other organisations.

We can’t wait to see what the startup does next, as we’re sure 2020 is going to be an immense year.

Pineapple Insurtech startup Pineapple is the third South African venture to make our watch list for 2020.

Founded in 2017, Pineapple allows users to get quotes and insurance on items with just the snap of a picture.

The startup has been going from strength to strength since launching, raising seed funding, and taking part in Google’s Launchpad Africa accelerator and the US-based Hartford Insurtech Hub’s accelerator.

Then in 2019, it won the single biggest prize at the annual VentureClash challenge in the United States (US), securing US$1.5 million from a US$5 million prize fund. With the milestones rolling in, we’re sure 2020 will be a stellar year for this startup.

EAST AFRICA

Exuus Rwandan fintech Exuus has had an exciting year; in particular, it has been busy honing its pitch to perfection.

The startup is taking traditional savings groups online in a bid to smooth processes and help low-income communities become more financially resilient.

In February, Exuus was one of 10 startups selected to pitch live to an audience of over 600 attendees at the annual Africa Startup Summit, held in Kigali; picked from more than 100 applicants from around the continent.

The startup was also named winner of Seedstars’ Rwandan event, securing a place in the global final, at which Exuus will pitch for up to US$500,000 in equity investment. We think they stand a good chance of coming out on top of the contest.

MPost Launched in 2015, it has taken Kenya’s MPost a while to get going, but recently things have started hotting up.

Simple but effective, MPost has developed a platform that enables the conversion of mobile numbers into official virtual addresses, which allows notifications to be sent to clients whenever they get mail through their postal addresses.

The startup participated in the Startupbootcamp AfriTech program held in Cape Town in late 2018; and this year raised a US$1.9 million Series A funding round to finance its expansion and further development of its proprietary platform.

We’ll be keeping our ears glued to the ground for more news from this exciting venture.

RideSafe Take motorbike taxis, affordable emergency response, and blockchain – mix them with a bucket of innovation and you get RideSafe. The Kenyan startup offers an emergency response service for public motorcycle taxis, that utilizes a micro-insurance financing model running on a decentralized blockchain application.

The startup has had quite the year – having raised US$100,000 in funding from æternity Ventures after taking part in the Bulgaria-based æternity Starfleet Incubator for blockchain startups; as well as being selected to pitch at the Africa Startup Summit in Rwanda in February.

We know we’ll be seeing big things from this company in 2020.

WEST AFRICA

OKO Finance It’s not every day a startup from Mali makes the list of the continent’s top 12 startups to watch – but OKO Finance has.

Founded in 2017, OKO develops affordable mobile-based crop insurance products to provide smallholder farmers with the financial security they need, regardless of unstable climate trends.

The startup raised pre-seed funding of US$300,000 but is now looking to raise US$1.5 million in order to grow more quickly. We feel confident they’ll get the backing, and we’re looking forward to seeing them scale their solution to more farmers and more markets in 2020.

Yobante Express At Disrupt Africa, we’re really excited about Senegalese startup Yobante Express, which has developed an innovative relay-based way of tackling last-mile deliveries.

Founded in November 2018, Yobante Express is an online marketplace that connects local couriers with local commerce; combining the gig economy and machine learning, to optimize domestic, cross-border, and last-mile delivery.

Already delivering over-delivering 8,000 parcels and generating more than US$50,000 every month, Yobante Express expanded to South Africa in November, and we have a feeling this startup will be pan-African before long.

54Gene Nigeria’s 54Gene means serious business: it is building the first African DNA biobank.

Just six months old, 54gene is a product of Stack Dx, which raised funding from early-stage VC firm Microtraction to develop the platform in January. Since then it has been selected to take part in the Y Combinator and Google Launchpad Africa accelerator programs, and in July, raised a US$4.5 million seed round.

The startup is now positioned to build the largest database of genomic and phenotypic consented data of Africans. And for us, there’s no doubt that this startup merits a spot on our must-watch list for 2020.